In an era of rising fuel costs and fluctuating freight rates, fleet operators are increasingly seeking ways to enhance visibility and optimize the performance of their assets. The emergence of connected trailer solutions has proven instrumental in improving operational efficiency and ensuring constant asset monitoring.

The responsibilities of trailers are quite clear-cut: remain securely connected to the tractor, safeguard the cargo during transportation from point A to B, and minimize any potential downtime. In the case of refrigerated units, they are additionally tasked with maintaining precise internal temperatures. On the surface, these tasks may seem straightforward.

However, the evolving challenges faced by fleets make it clear that simply meeting the basic requirements is no longer sufficient. In today’s dynamic landscape of fluctuating fuel costs, unpredictable freight rates, and various other uncertainties, fleets demand greater visibility into the status and performance of their assets. It has become imperative to incorporate smart technology that connects individual assets to the broader operation, enabling continuous monitoring of their location and condition. By harnessing real-time and historical data, these smart solutions empower fleets with valuable insights into their assets’ health and enable more informed decision-making.

According to Sean Kenney, Chief Sales Officer at Hyundai Translead, the adoption of new technologies is becoming increasingly prevalent in the industry, with a steady rise in solutions that enhance maintenance efficiency, fuel economy, and data utilization for customer operations. Many fleets are already acquainted with certain smart features, such as tire inflation system monitoring and GPS sensors for asset tracking.

With the implementation of systems like Utility Connect, a collaboration between Utility Trailer and technology provider Phillips Connect, fleets now have the capability to access a range of additional functionalities. By integrating Utility’s wiring harness with Phillips Smart7 nosebox, fleets can receive ABS fault codes and receive alerts if trailer lights are not functioning. On the operational front, the system enables verification of cargo presence through the use of cameras or ultrasonic sensors. Moreover, the system can evolve and improve through over-the-air updates, facilitating communication with other systems such as the Bendix roll-stability system or brake-pad wear sensors.

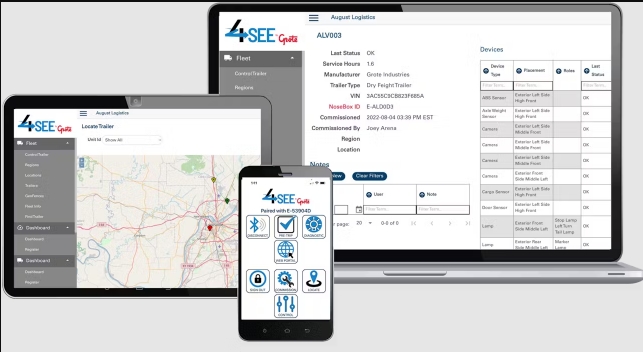

Additional solutions in the market offer advanced functionalities to enhance fleet operations. For instance, Aperia’s Halo Connect and Pressure System International’s TireView provide tire pressure monitoring capabilities to prevent blowouts and improve fuel economy. ConMet’s PreSet Plus SmartHub offers valuable data on hub, tire, and brake performance. Grote Industries’ 4SEE Smart Trailer System and Great Dane’s FleetPulse platform function similarly to Utility Connect, providing comprehensive trailer monitoring and management features. Reefer fleets can also benefit from Thermo King’s TracKing telematics platform, which offers end-to-end visibility and control over transport refrigeration units (TRUs).

With an array of options available, fleet personnel face a challenging task when selecting or upgrading trailers. The complexity of these choices may seem daunting, but considering the numerous benefits they offer, trailer connectivity should be seriously contemplated, either now or in the near future. Embracing trailer connectivity can bring significant advantages to fleet operations and pave the way for enhanced efficiency and effectiveness.

The time is now

During the American Transportation Associations’ Technology & Maintenance Council 2022 Fall Meeting, industry experts highlighted the increasing trend of fleet adoption in trailer connectivity technology. Rob Phillips, the founder and CEO of Phillips Connect, projected significant growth in this area. He estimated that by the end of 2023, there would be 350,000 smart trailers on the road, and this number is expected to reach 1,500,000 by 2026 and 2,000,000 by 2027. These projections indicate a strong upward trajectory in the adoption of smart trailer technology within the industry.

According to Phillips Connect, there is a strong expectation that within the next three years, telematics will be incorporated into approximately 70% of new trailers. This percentage is projected to surpass 80% within the next five years. Phillips Connect has already supplied 150,000 smart-trailer gateways and over 1 million sensors to customers. These gateways, such as Smart7, StealthNet, and SolarNet, offer valuable trailer health data and analytics tools to fleets, enhancing their operational efficiency and decision-making capabilities.

Phillips emphasizes that their tools go beyond simply tracking trailer location and provide fleets with the ability to assess maintenance requirements and determine the suitability of trailers for use. The company states that their solutions have resulted in significant enhancements to trailer tire lifespan and increased asset utilization for fleets.

According to Phillips, an OEM has disclosed that they are equipping telematics on approximately 50% of their shipped trailers and almost all of their built reefers. Phillips believes that this trend is likely consistent across other manufacturers as well. Specifically, Phillips has observed a rapid increase in the number of truck-trailer combinations that prioritize monitoring the overall health of the equipment.

He expressed his belief that the industry is reaching a crucial turning point, with a growing number of large fleets recognizing the advantages of smart trailers. This increasing interest is generating significant momentum, which will further drive the adoption of comprehensive smart trailer telematics. Phillips emphasized his excitement about this development and the opportunities it brings.

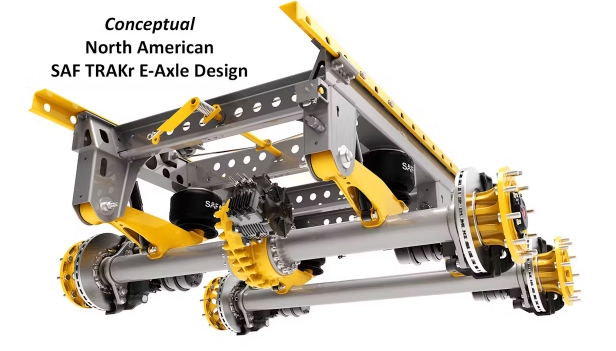

According to Lance Gage, SAF-Holland’s product manager of trailer axles & suspension systems, there is a noticeable increase in OEM partnerships and collaborations related to smart trailers. Gage stated that fleets are expressing their readiness for this new technology and indicating that OEMs have been somewhat delayed in providing it.

In North America, SAF offers various smart trailer components such as SAF Tire Pilot Plus and SAF automated coupling. Gage believes that it is quite possible to imagine a future where all newly built trailers, within the next five to ten years, will come equipped with a range of smart trailer options or customizable levels that cater to specific fleet applications and requirements.

Recognizing the advantages of smart trailer connectivity, Gage emphasized the importance of looking ahead to the future. He anticipates further advancements in the near future that will enable monitoring of crucial operational parameters on trailers, leading to significant improvements in overall safety and fleet performance. Gage highlighted the common scenario where fleet operators express regret, saying, “If only I had known,” regarding a trailer issue that could have been promptly and safely addressed with lower costs had they been aware of it earlier.

According to Lisa Mullen, CEO of Drōv Technologies, the increasing adoption of smart or connected trailers is expected to accelerate, particularly among fleets with sustainability initiatives or autonomous objectives. Drōv Technologies offers the AirBoxOne smart trailer platform, which, in partnership with SKF Vehicle Aftermarket, enables the monitoring of vibration and temperature data at the wheel end.

According to Mullen, the inclusion of smart trailers should be a priority for fleets in their decision-making process. As industry costs continue to rise, the potential for efficiency savings, particularly in terms of tire maintenance, becomes increasingly significant. Nicola Zingraf-Bolton, Head of Digital Solutions for the ZF Group CVS division in the Americas, emphasized that time is money for fleets engaged in freight forwarding operations.

According to Zingraf-Bolton, trailer connectivity plays a crucial role in enhancing daily operations by providing real-time load status and tracking information. This enables fleets to remotely diagnose and address any technical faults, minimizing downtime. It also enables workshops to improve their service scheduling and preparations, resulting in faster vehicle turnaround times and reduced disruptions on the road.

According to Ross Froat, the executive director of Great Dane’s FleetPulse, there has been a significant increase in motor carriers’ interest in trailer connectivity technology compared to a few years ago. Froat mentioned that Great Dane observed heightened competition in 2019, particularly in the area of enhanced GPS tracking. He attributed this growing interest to the impact of COVID-19, which brought about a greater focus on data and remote work. Froat highlighted the convenience of accessing FleetPulse or similar platforms from anywhere through a phone, laptop, or computer, enabling remote asset management tasks to be performed seamlessly.

Connecting the benefits

Increased transparency in trailer health is expected to greatly benefit maintenance departments. By reducing the number of tires to be replaced and streamlining overall trailer management, maintenance teams will have more time and resources to address critical issues. The use of telematics and data analytics enables proactive identification of trailer issues, eliminating the reliance on human operators to discover problems before they escalate into major incidents. This enhanced efficiency and early detection capabilities contribute to minimizing downtime and preventing costly trailer failures.

The cold chain industry stands to benefit significantly from these advancements, particularly in preventing the spoilage of perishable goods like frozen foods. Adam Jaberi, senior product owner of telematics and connected solutions at Thermo King, highlighted the importance of telematics in this context. He explained that without telematics, drivers are solely responsible for setting the temperature and operating mode of the reefer unit correctly. By providing a second set of eyes and additional validation, telematics offers peace of mind to both drivers and fleet managers, ensuring that temperature-sensitive cargo remains properly monitored and protected throughout the transportation process.

According to Adam Jaberi, there is still a lack of understanding within the industry regarding the full potential of trailer connectivity. Currently, in the reefer sector, sensors are primarily used for monitoring location and temperature data. However, as implementation progresses, customers begin to realize that telematics can offer much more than just temperature monitoring. They discover that it can encompass various aspects of fleet operations. This realization marks a transition from the initial phase, where telematics is primarily used for basic functions, to a phase where customers start exploring additional use cases such as dwell time reporting, geofencing capabilities, and customer reporting.

In addition, the data obtained from trailer telematics can uncover areas where a fleet may be underperforming, according to Jaberi. Initially, fleets may believe they are operating at optimal levels, but the data reveals areas that have room for improvement. While this realization may raise concerns for some fleets regarding aspects such as safety and fuel efficiency, it ultimately presents an opportunity for positive outcomes and overall enhancement.

According to Steven Walters, senior product owner of telematics for Thermo King, there is a noticeable shift in the type of customer requests for telematics. He explains that dry fleets, which previously may not have embraced telematics, are now recognizing the advantages it offers. These include adopting a more comprehensive approach to monitoring their entire fleet, enabling them to make informed decisions and optimize their operations.

Smart trailers offer a multitude of benefits, and one area where they can have a significant impact is on trailer tires. Tires often contribute to breakdowns and expensive repairs, making them an easy target for improvement. Jake Martin, marketing support specialist at Pressure Systems International (P.S.I.), explains that the ability to detect low or leaking tires enables fleets to prevent tire and wheel end issues while also reducing fuel costs associated with underinflation. By addressing tire problems proactively, fleets can enhance safety, reduce maintenance expenses, and improve overall operational efficiency.

Martin highlights the importance of maintaining proper tire inflation, explaining that adequately inflated tires have reduced rolling resistance, leading to improved fuel economy. This not only benefits fleet costs but also contributes to environmental sustainability. While connected technology offers advantages for almost any fleet, Martin emphasizes that the value is particularly significant for fleets engaged in long-haul operations or those handling time-sensitive and valuable cargo. Additionally, trailer fleets that rely on external drivers or have shared assets, such as lease fleets and trailer pools, greatly benefit from the visibility provided by connected technology, even when the trailers are not in their direct possession.

Martin highlights the key objective of reducing the driver’s responsibility in monitoring the trailer’s various systems and enabling them to concentrate more on driving. The implementation of connected technology in trailers aims to automate and enhance the monitoring process, minimizing the driver’s involvement in routine checks and maintenance tasks. By offloading these responsibilities, drivers can prioritize safe and efficient driving, leading to improved overall performance and productivity.

Prepping for adoption and expansion

Biank emphasized the cost-saving potential of an interconnected trailer system. By ensuring optimal performance and efficiency, fleets can mitigate operating expenses, especially during challenging economic periods. Biank noted that while there is a significant increase in the adoption of trailer telematics, early adopter fleets are now seeking additional features and capabilities to further enhance their operations. The focus is shifting towards advanced functionalities that go beyond basic connectivity, indicating a growing demand for comprehensive solutions that provide even greater benefits and insights.

Biank raised a thought-provoking question about human nature: the desire for more. In the context of trailer connectivity, he highlighted how it builds upon the foundation of telematics, offering additional possibilities. These advancements may involve integrating ABS, lighting systems, sensors, and cameras, expanding the scope of functionality and data collection. Biank emphasized the importance of having a standardized communication protocol for trailers to enable seamless integration and interoperability among various components and systems.

In the coming years, Grote Industries and other providers will actively work towards establishing a standardized framework for smart trailers. This effort will involve addressing technology advancements, sustainability objectives, and operational requirements while enhancing connectivity. Biank anticipated that fleets with such goals in mind would be at the forefront of adopting this technology, positioning themselves as early adopters. Additionally, tanker fleets are expected to be among the initial adopters of smart trailers, according to Gage from SAF.

Gage from SAF highlighted that tanker fleets, given their weight-sensitive and safety-critical nature, are logical candidates to be early adopters of smart trailers. Integration of sensors, such as tire pressure management with load-based adjustments and cameras for fuel discharge, is already evident in this sector. When selecting these smart components, fleets should consider not only the current state of technology but also its future growth and improvements. Martin from P.S.I. emphasized the importance for fleets to assess the expandability of systems, ensuring that their initial solution can accommodate additional integrations in the future. It is crucial for fleets to evaluate the return on investment (ROI) of these add-ons for their operations.

Phillips agreed

According to Phillips, starting with a Tire Pressure Monitoring System (TPMS) is a practical way for fleets to begin saving, but it is essential to future-proof their fleet by anticipating technological advancements. By initially implementing a capable wiring harness and smart gateway, fleets can gradually incorporate additional sensors as needed. Grote Industries addresses this challenge with their 4SEE smart trailer system, which combines hardware and software to provide truck fleets with extensive access to operational data. Biank emphasizes that 4SEE aims to establish a unified communication stream within the trailer, creating an infrastructure that can seamlessly integrate with current and future components. The goal is to enable connectivity for any type of component, both present and future, in a standardized manner.

Final considerations

Paul Washicko, the general manager and VP of ConMet Digital, acknowledged that equipping trailers with smart technology in existing fleets can be a challenging and time-consuming task. The process of outfitting trailers in a shop requires careful consideration and planning. However, even after implementation, the abundance of data provided by smart trailer technology can overwhelm fleet management. Washicko pointed out that some fleets may discover that they lack the necessary processes and procedures to effectively utilize the increased visibility and insights offered by the technology. It becomes crucial for fleets to establish appropriate workflows and systems to make the most of the available data and maximize the benefits of smart trailer technology.

Paul Washicko emphasized that fleets have historically dealt with issues reactively. However, with the implementation of smart trailer technology, the challenge lies in integrating these issues into normal operations seamlessly. For instance, when a tire problem arises, it becomes crucial to incorporate its resolution efficiently without disrupting the trailer’s overall utilization. Helping customers navigate this integration within their existing systems is a priority.

SAF-Holland, on the other hand, focuses on preventing data overload for fleets. According to Gage, the company collaborates with each fleet to identify the specific attributes that are of utmost concern and importance to them. This approach ensures that only actionable issues are communicated as alerts, streamlining the flow of information and allowing fleets to address critical matters promptly. By tailoring the notification algorithms to the fleet’s needs, SAF-Holland helps optimize the utilization of smart trailer data while avoiding unnecessary notifications and mitigating the risk of data overload.

Gage acknowledged that with the market’s expansion, fleets will encounter an increasing number of signals and data integrators to handle. In light of this, when choosing a platform to invest in, customers should prioritize simplicity by consolidating their systems.

ZF Group’s Zingraf-Bolton emphasized that fleets have often been compelled to deploy multiple systems on a single asset to access all the necessary data points, resulting in higher costs for monthly subscription services. To address this, telematics solutions that offer the capability to combine multiple features within a single system are crucial. Not only do they enable better cost control, but they also significantly reduce the complexity of installation on a trailer. By opting for consolidated platforms, fleets can streamline their operations and achieve greater efficiency.

Froat explains that Great Dane, being a trailer manufacturer, has the advantage of cost control due to its ability to collaborate with integration partners in various ways. Owning the trailer facilitates seamless advancements, data integration, and technology integration within FleetPulse. However, in the industry, there are challenges related to data integration when partnering with other entities to develop a product that serves customers and competes with larger smart trailer suppliers.

Biank acknowledges that achieving cooperation among all parties involved in the trailer connectivity realm can be a challenge. Harmonizing efforts and fostering collaboration among different stakeholders can be complex in this dynamic environment.

Biank emphasizes the importance of fostering cooperation among various platforms and offerings in the trailer space. Ensuring compatibility and smooth integration between different components is crucial. Grote Industries has taken an agnostic approach, integrating all trailer components into their system while allowing vendors to retrieve their own data. This approach prioritizes accessibility for both end-users and component vendors, recognizing the need for vendors to have access to their specific data within the interconnected trailer ecosystem.